UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to | |

The TJX Companies, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

770 Cochituate Road Framingham, Massachusetts 01701 April Dear We cordially invite you to attend our The proxy statement accompanying this letter describes the business we will consider at the meeting. Please read the proxy statement and vote your shares. Your vote is important regardless of the number of shares you own. Instructions for online and telephone voting are attached to your proxy card. If you prefer, you can vote by mail by completing and signing your proxy card and returning it in the enclosedpre-paid return envelope. We hope that you will be able to join us on June Sincerely,

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS June The

Election of the directors named in this proxy statement

Ratification of appointment of PricewaterhouseCoopers as TJX’s independent registered public accounting firm for fiscal

Advisory approval of TJX’s executive compensation (thesay-on-pay vote)

Shareholder proposal for a report on compensation disparities based on race, gender, or ethnicity

Shareholder proposal for a

Shareholder proposal for a report on human rights risks Any other business properly brought before the meeting Shareholders of record at the close of business on April To attend the Annual Meeting, you must show that you were a TJX shareholder at the close of business on April By Order of the Board of Directors, Alicia C. Kelly Secretary Framingham, Massachusetts April YOUR VOTE IS IMPORTANT. PLEASE VOTE ONE OF THE FOLLOWING WAYS:

FISCAL

FISCAL 2019

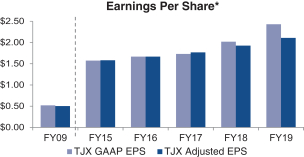

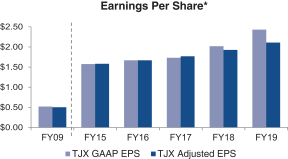

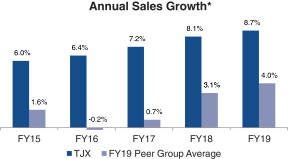

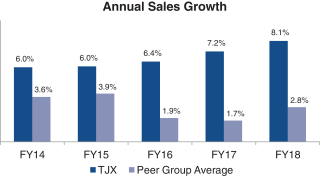

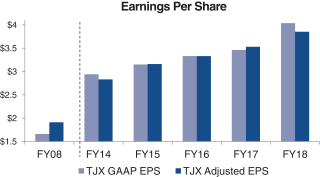

Our EPS growth continued in fiscal 2019, and our long-term total shareholder return growth rates and annual sales growth continued to be strong relative to our fiscal 2019 peer group (detailed below underCompensation Discussion and Analysis: The Role of Our Peer Group).

2019 Proxy Statement 1

GOVERNANCE HIGHLIGHTS

Board Refreshment. In September 2018, our Board elected Rosemary Berkery to join the Board and to serve on the Audit Committee and the Executive Compensation Committee. Ms. Berkery is included with the other nominees standing for election at this annual meeting; seeProposal 1: Election of Directors, below. In addition, José Alvarez did not stand for election at our last annual meeting and his service on our board ended in June 2018.

Engaging with Shareholders. Our fiscal Corporate Responsibility. Our Corporate Responsibility program reflects our ‘smart for business, good for the world’ thinking. We categorize our global corporate responsibility efforts under four pillars, described further in theCorporate Responsibility section on p. 13 of this proxy statement:

We remain focused on enhancing our

VOTING ITEMS FOR

The Board of Directors of

Election of the directors named in this proxy statement (see p.

Ratification of appointment of PricewaterhouseCoopers as TJX’s independent registered public accounting firm for fiscal

Advisory approval of TJX’s executive compensation (thesay-on-pay vote) (see p.

Three shareholder proposals, if properly presented (see proposals starting on p.

If you owned TJX common stock at the close of business on April

If you are ashareholder of record (meaning you hold TJX shares registered in your name),

If you are astreet name holder With proper documentation, you may also vote in person at the meeting. Please seeVoting Requirements and Practices on p. This proxy statement, the proxy card, and the Annual Report to Shareholders for our fiscal year ended February

Please note below other topics included in this proxy statement that may be of interest. This list does not cover all information included in this proxy statement that you should consider. You should review the entire proxy statement carefully before voting your shares.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON JUNE

Integrity has always been a core tenet of TJX. We seek to perform with the highest standards of ethical conduct and in compliance with all laws and regulations that relate to our businesses. Our core Board practices and policies are reflected in our Corporate Governance Principles and Director Code of Business Conduct and Ethics. Our Board also maintains written charters for each of our Board committees, discussed further below.

Our Board of Directors is responsible for overseeing the business and affairs of the company, and, as part of this responsibility, for regularly monitoring the effectiveness of management’s implementation of strategy, policies, and decisions. The Board, with management, also believes that the interests of our shareholders are enhanced by responsibly considering the interests of our customers, Associates, suppliers, service providers, and communities where we operate. During the year, our Board reviews our strategies with management, including both our long-term strategy and annual plans for capital allocation and shareholder distributions. For fiscal 2019, strategies The Board also

RISK OVERSIGHT

It is management’s responsibility to manage risk and bring to the Board’s attention risks that are material to TJX. The Board has oversight responsibility for the systems established to report and monitor the most significant risks applicable to TJX. The Board administers its risk oversight role directly and through its committee structure and the committees’ regular communications with the full Board. The committees escalate risks to the full Board as they determine to be appropriate. In general terms:

The Board reviews strategic, financial, and execution risks and exposures associated with the annual plan and multi-year plans; any major litigation and other matters that may present material risk to our operations, plans, prospects, or reputation (including those related to human capital management, supply chain, and environmental sustainability); significant acquisitions and divestitures; and senior management succession planning. The Board receives regular reports from our Chief Risk and Compliance Officer.

The Audit Committee reviews risks associated with financial and accounting matters, including financial reporting, accounting, disclosure, internal controls over financial reporting, ethics and compliance programs, compliance with orders, data security, and cybersecurity, and helps oversee management’s processes to identify the material risks that we face as a company, including through our enterprise risk management program. The Audit Committee receives regular reports from our Chief Risk and Compliance Officer.

The Corporate Governance Committeereviews risks related to Board and CEO evaluations, management succession, and Board composition.

The Executive Compensation Committee (ECC) reviews risks related to executive compensation and the design of our compensation programs, plans, and arrangements.

The Finance Committeereviews risks related to financing plans, investment policies, capital structure and liquidity; tax strategies; foreign currency exchange and commodity hedging policies; insurance programs; and investment performance, asset allocation strategies, and funding of our pension and retirement benefit plans.

LEADERSHIP STRUCTURE

Our Board has separated the role of CEO and Chairman. Carol Meyrowitz has served as Chairman of the Board since June As provided in our Corporate Governance Principles, because our current Chairman is not independent, our independent directors have elected an independent Lead Director, John F. O’Brien, to serve as a liaison between the independent directors, the Executive Chairman, and management. The Board believes that the separate roles of Chairman, Chief Executive Officer, and Lead Director are in the best interests of TJX and its shareholders. Lead Director Role As Lead Director, Mr. O’Brien provides independence in TJX’s Board leadership through his review and approval of Board meeting agendas, his participation in management business review meetings, and his leadership of the independent directors.

Meeting at least quarterly with our Chief Executive Officer and Meeting with other executives and senior leadership as necessary; Generally attending regular management business review meetings; Scheduling meetings of the independent directors; Presiding at meetings of the Board in the Approving Board meeting schedules and Attending the meetings of each Board committee; and Undertaking other responsibilities designated by the independent directors, or as otherwise considered appropriate.

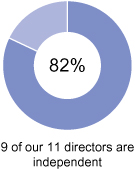

Board Independence

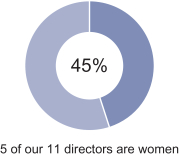

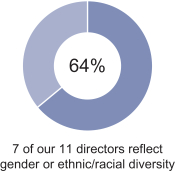

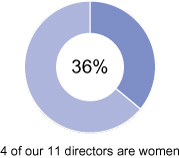

As a result of this review, our Board unanimously determined that 9 directors of our current11-member Board are independent: Zein Abdalla, Board Diversity As a global company with approximately The Corporate Governance Committee does not have a formal diversity policy that is applied when evaluating the suitability of individual Board nominees, but takes diversity, including

diversity of experience. We value the many kinds of diversity reflected in our Board and director nominees. 6 The TJX Companies, Inc.

Board Composition

Board Assessment The Board believes it is important to have highly engaged directors and that the Board’s Currently, Director Qualifications and Nominations The Corporate Governance Committee recommends to the Board individuals to be director nominees who, in the opinion of the Committee, have high personal and professional ethics, integrity, and values; have demonstrated ability and judgment; and will be committed to collectively serving the long-term best interests of our shareholders. The

Finding Candidates. The Corporate Governance Committee’s process for identifying and evaluating candidates, including candidates recommended by shareholders, includes actively seeking The Corporate Governance Committee has a policy for shareholder recommendations of candidates for director nominees, which is available on our website. Any shareholder may submit, in writing, one candidate for consideration for each shareholder meeting at which directors are to be elected. Shareholders wishing to recommend a candidate must submit the recommendation by a date not later than the 120th calendar day before the first anniversary of the date that we released our proxy statement to shareholders in connection with the previous year’s annual meeting. Recommendations should be sent to the Corporate Secretary of TJX: Office of the Secretary/Legal Department The TJX Companies, Inc. 770 Cochituate Road Framingham, Massachusetts 01701 As described in the policy, a recommendation must provide specified information about the candidate as well as certifications from, and consents and agreements of, the candidate. The Corporate Governance Committee evaluates candidates for the position of director recommended by shareholders in the same manner as candidates from other sources. The Corporate Governance Committee will determine whether to interview any candidates and may seek additional information about candidates from third-party sources. Majority Voting Ourby-laws provide for the election of directors in an uncontested election by a majority of the shares properly cast at the meeting. Our Corporate Governance Principles require any incumbent nominee for director to provide an irrevocable contingent resignation to the Corporate Secretary of TJX at least 14 days in advance of the distribution date for proxy solicitation materials for the shareholder meeting at which such director is expected to be nominated to stand for election. This resignation would be effective only if (a) the director fails to receive the requisite majority vote in an uncontested election and (b) the Board accepts the resignation. Our Corporate Governance Principles provide procedures for the consideration of this kind of resignation by the Board. Within 90 days of the date of the annual meeting of shareholders, the Board, with the recommendation of the Corporate Governance Committee, will act upon such resignation. In making its decision, the Board will consider the best interests of TJX and its shareholders and will take what it deems to be appropriate action, which may include accepting or rejecting the resignation or taking further measures to address those concerns that were the basis for the underlying shareholder vote. Board Service Policies Under our Corporate Governance Principles, directors who are CEOs of public companies should not serve on more than two boards of public companies besides their own, and no director should serve on more than five boards of public companies, including the TJX Board. Under our Audit Committee Charter, members of the Audit Committee should not serve on the audit committee of more than two other public companies. When a director’s principal occupation or business association changes during his or her tenure as a director, our Corporate Governance Principles provide that the director is required to tender his or her resignation from the Board, and the Corporate Governance Committee will recommend to the Board any action to be taken with respect to the resignation. Stock Ownership Guidelines for Directors. Our Corporate Governance Principles provide that anon-employee director is expected to attain stock ownership with a fair market value equal to at least five times the annual retainer paid to the director within five years of initial election to the Board.

Board Attendance. During fiscal

The Board of Directors has five standing committees: Audit, Corporate Governance, Executive Compensation, Finance, and an Executive Committee, each described in more detail below. All members of the Audit, Corporate Governance, Executive Compensation, and Finance Committees arenon-employee directors and meet the independence standards adopted by the Board in compliance with NYSE listing standards for that committee. The Executive Committee includes our Executive Chairman who is not independent. While each committee has specific, designated responsibilities, each committee may act on behalf of the entire Board to the extent designated by the respective charter or otherwise by the Board. The Corporate Governance Committee annually reviews and makes recommendations on the composition of our standing committees. Our committees regularly invite all other Board members to join their meetings and, as necessary, otherwise report on their activities to the entire Board. Our Lead Director attended all committee meetings during fiscal 2019. The table below provides information about current membership and the meetings of these committees during fiscal

Each director attended at least 75% of all meetings of the Board and committees of which he or she was then a member.

AUDIT COMMITTEE

Mr. Hines, Chairman; The Audit Committee is directly responsible for the appointment, compensation, retention, and oversight of the independent registered public accounting firm retained to audit the company’s financial statements and assists the Board in its oversight of the integrity of the Company’s financial

reviewing and discussing with management, internal auditors, and the independent registered public accounting firm our quarterly and annual financial statements, including the accounting principles and procedures applied in their preparation and any changes in accounting policies;

monitoring our system of internal financial controls and accounting practices;

2019 Proxy Statement 9

overseeing the audit process, including the annual audit;

overseeing our compliance and ethics programs;

overseeing, in conjunction with the Board, our enterprise risk management program; establishing and maintaining procedures for receipt, retention, and treatment of complaints, including the confidential and anonymous submission of complaints by

selecting, retaining, negotiating, and approving the compensation of, overseeing, and if necessary, replacing, the independent registered public accounting firm;

pre-approving all work by the independent registered public accounting firm; and

other matters as the Board considers appropriate. As part of these responsibilities, in addition to assuring the regular rotation of the lead partner of the independent auditor, as required by law, the Audit Committee, including its Chairman, is involved in the selection of, and reviews and evaluates the performance of, the independent auditor, including the lead audit partner, and further considers whether there should be regular rotation of the audit function among firms. Please see the Audit Committee charter, available on our website, tjx.com, for further details.

CORPORATE GOVERNANCE COMMITTEE

Ms. Shire, Chairman; Mr. Abdalla; Mr. The Corporate Governance Committee’s responsibilities include, among other things:

recommending director nominees to the Board;

developing, recommending to the Board, and reviewing corporate governance principles;

in concert with the Board, reviewing our policies with respect to significant issues of corporate social and public responsibility, including political contributions and activities, environmental and sustainability activities, and charitable giving;

reviewing practices and policies with respect to directors and the structure and frequency of Board meetings;

reviewing the functions, duties, and composition of the committees of the Board and making recommendations regarding compensation for Board and committee members;

recommending processes for the annual evaluations of the performance of the Board, each individual director, the Chairman, the independent Lead Director, and each committee and its

establishing performance objectives for the Chief Executive Officer and annually evaluating the performance of the Chief Executive Officer against such objectives; and

overseeing the maintenance and presentation to the Board of management’s plans for succession to senior management positions. Please see the Corporate Governance Committee charter, available on our website, tjx.com, for further details.

EXECUTIVE COMPENSATION COMMITTEE

Mr. Bennett, Chairman; The ECC’s responsibilities include, among other things:

reviewing and approving the structure and philosophy of compensation of the Chief Executive Officer, other executive officers, and senior Associates;

approving the compensation and benefits, including awards of stock options, bonuses, and other awards and incentives, of our executive officers and other Associates in those categories as are from time to time identified by the ECC;

determining the compensation of the Chief Executive Officer, including awards of stock options, bonuses, and other awards and incentives, based on the evaluation by the Corporate Governance Committee of the performance of the Chief Executive Officer and such other factors as the ECC deems relevant;

determining the performance goals and performance criteria under our incentive plans;

approving the terms of employment of our executive officers, including employment and other agreements with such officers;

overseeing the administration of our incentive plans and other compensatory plans and funding arrangements; and

reviewing and undertaking other matters that the Board or the ECC deems appropriate, such as the review of our succession plan for the Chief Executive Officer and other executive officers. Pursuant to its charter, the ECC may delegate its authority to a subcommittee or to such other person that the ECC determines is appropriate and is permitted by applicable law, regulations, and listing standards. The ECC also reviews our compensation policies and practices for our Associates to determine whether they give rise to risks that are reasonably likely to have a material adverse effect on the company. SeeCompensation Program Risk Assessment, below. Please see the ECC charter, available on our website, tjx.com, for further details.

FINANCE COMMITTEE

Ms. Lane, Chairman; Mr. Abdalla; Mr. Bennett; and Mr. Hines The Finance Committee is responsible for reviewing and making recommendations to the Board relating to our financial activities and condition. The Finance Committee’s responsibilities include, among other things:

reviewing and making recommendations to the Board with respect to our financing plans and strategies; financial condition; capital structure; tax strategies, liabilities, and payments; dividends; stock repurchase programs; and insurance programs;

approving our cash investment policies, foreign exchange risk management policies, commodity hedging policies, capital investment criteria, and agreements for borrowing by us and our subsidiaries from banks and other financial institutions; and

reviewing investment policies as well as the performance and actuarial status of our pension and other retirement benefit plans. Please see the Finance Committee charter, available on our website, tjx.com, for further details.

EXECUTIVE COMMITTEE

Ms. Meyrowitz, Chairman; Ms. Lane; and Mr. O’Brien The Executive Committee meets at such times as it determines to be appropriate and has the authority to act for the Board on specified matters during the intervals between meetings of the Board.

COMPENSATION PROGRAM RISK ASSESSMENT

As part of our regular enterprise risk assessment process overseen by the Board and described above, we review the risks associated with our compensation plans and arrangements. In fiscal The assessment was led by our Chief Risk and Compliance Officer, whose responsibilities include leadership of our enterprise risk management process, and included consultation with and input from, among others, executive officers,

The assessment also considered the balance of potential risks and rewards related to our compensation programs and the role of those programs in implementing our corporate strategy.

CODES OF CONDUCT AND ETHICS AND OTHER POLICIES

Global Code of Code of Ethics for TJX Executives and Director Code of Business Conduct and Ethics. As noted above, we have a Director Code of Business Conduct and Ethics that is designed to promote honest and ethical conduct; compliance with applicable laws, rules, and regulations; and the avoidance of conflicts of interest for our Board members. We also have a Code of Ethics for TJX Executives governing our Executive Chairman, Chief Executive Officer and President, Chief Financial Officer, and other senior operating, financial, and legal executives. The Code of Ethics for TJX Executives is designed to ensure integrity in our financial reports and public disclosures. We intend to disclose any future amendments to, or waivers from, the Code of Ethics for TJX Executives and the Director Code of Business Conduct and Ethics, as required, within four business days of the waiver or amendment through a posting on our website or by filing a Current Report on Form8-K with the Securities and Exchange Commission, or SEC.

ONLINE AVAILABILITY OF INFORMATION

Our Corporate Governance Principles, Global Code of Conduct, Code of Ethics for TJX Executives, Director Code of Business Conduct and Ethics, and charters for our Audit, Corporate Governance, Executive, Executive Compensation, and Finance Committees are available on our website, tjx.com, in theInvestors section under Governance: Governance Documents. Information appearing on tjx.com is not a part of, and is not incorporated by reference in, this proxy statement.

For more than Our evolving global corporate responsibility

Our Workplace, which reflects our commitment to our Associates worldwide, including fostering

Our Communities, which focuses on our mission to help vulnerable families and children access the resources and opportunities they need to build a better future. Through charitable giving, volunteer efforts, community partnerships, andin-store fundraising, we

Environmental Sustainability, which reflects our longstanding commitment to pursue initiatives that are smart for our business and good for the environment. We have continually focused on meaningful initiatives that are aligned with our business goals to help reduce our environmental impact, drive operational cost reductions, and demonstrate our ongoing commitment to environmental sustainability. Key initiatives include increasing energy efficiency, reducing fuel usage, participating in recycling and waste management, and developing greener building designs. We remain focused on reducing our carbon footprint and are driving towards the achievement of our greenhouse gas (GHG) reduction goal, which is to reduce our global GHG emissions

Responsible Business, which reflects our commitment to operating ethically, sourcing responsibly, We remain focused on 2019 Proxy Statement 13

We are interested in hearing from our shareholders and communicate regularly with shareholders throughout the year. Security holders and other interested parties may communicate directly with our Board, thenon-management directors or the independent directors as a group, the Lead Director, or any other specified individual director or directors. To contact us, address your correspondence to the individual or group you would like to reach and send it to us, c/o the Corporate Secretary, who will forward these communications to the appropriate group or individual: Office of the Secretary/Legal The TJX Companies, Inc. 770 Cochituate Road Framingham, Massachusetts 01701

Audit Committee, c/o Corporate Internal Audit Director, The TJX Companies, Inc., 770 Cochituate Road, Framingham, Massachusetts 01701.

TRANSACTIONS WITH RELATED PERSONS

Under its charter, the Corporate Governance Committee is responsible for reviewing and approving or ratifying any transaction in which, in addition to TJX, any of our directors, director nominees, executive officers (or their immediate family members), or any greater than 5% shareholders (or their immediate family members) is a participant and has a direct or indirect material interest, as provided under SEC rules. In the course of reviewing potential related person transactions, the Corporate Governance Committee considers the nature of the related person’s interest in the transaction; the presence of standard prices, rates, or charges or terms otherwise consistent with arms-length dealings with unrelated third parties; the materiality of the transaction to each party; the reasons for TJX entering into the transaction with the related person; the potential effect of the transaction on the status of a director as an independent, outside, or disinterested director or committee member; and any other factors the Corporate Governance Committee may deem relevant. Our General Counsel’s office is primarily responsible for the implementation of processes and procedures for screening potential transactions and providing information to the Corporate Governance Committee. During fiscal

The Audit Committee operates in accordance with a written charter adopted by the Board and reviewed annually by the Committee. We are responsible for overseeing the quality and integrity of TJX’s accounting, auditing and financial reporting practices. The Audit Committee is composed solely of members who are independent, as defined by the NYSE and TJX’s Corporate Governance Principles. Further, the Board has determined that two of our members (Mr. Hines and Ms. Lane) are audit committee financial experts as defined by the rules of the SEC. 14 The TJX Companies, Inc.

We met We took numerous actions to discharge our oversight responsibility with respect to the audit process. We reviewed and discussed the audited financial statements of TJX as of and for fiscal We reviewed and discussed with PwC communications required by the Standards of the PCAOB (United States), as described in PCAOB Auditing Standard 1301, “Communication with Audit Committees,” and, with and without

management present, discussed and reviewed the results of PwC’s examination of TJX’s financial statements. We also discussed the results of the internal audit examinations with and without management present. Based on these reviews and discussions with management and PwC, we recommended to the Board that TJX’s audited financial statements be included in its Annual Report on Form10-K for fiscal Audit Committee Michael F. Hines,Chairman

David T. Ching Amy B. Lane

AUDITOR FEES

The aggregate fees that TJX was billed for professional services rendered by PwC for fiscal

Audit fees were for professional services rendered for the audits of TJX’s consolidated financial statements including financial statement schedules and statutory and subsidiary audits,

Audit related fees were for consultations concerning financial accounting and reporting standards and employee benefit plan

Tax fees were for services related to tax compliance, planning and advice, including assistance with tax audits and appeals,

All other fees were primarily for services related to our environmental sustainability 2019 Proxy Statement 15

The Audit Committee is responsible for the audit fee negotiations associated with the company’s retention of PwC. The Audit Committeepre-approves all audit services and all permittednon-audit services by PwC, including engagement fees and terms. The Audit Committee has delegated the authority to take such action between meetings to the Audit Committee chairman, who reports the decisions made to the full Audit Committee at its next scheduled meeting. Our policies prohibit TJX from engaging PwC to provide any services relating to bookkeeping or other services related to accounting records or financial statements, financial information system design and implementation, appraisal or valuation services, fairness opinions orcontribution-in-kind reports, actuarial services, internal audit outsourcing, any management function, legal services or expert services not related to audit, broker-dealer, investment adviser, or investment banking services, or human resource consulting. In addition, the Audit Committee evaluates whether TJX’s use of PwC for permittednon-audit services is compatible with maintaining PwC’s independence. The Audit Committee concluded that PwC’s provision ofnon-audit services, which were approved in advance, was compatible with their independence.

PROPOSAL 1: ELECTION OF DIRECTORS Nominees and Their Qualifications The individuals listed below have been nominated and are standing for election at this year’s Annual Meeting. If elected, they will hold office until our

Please see theBoard Service at TJX section, above, for additional information about director qualifications and how we assess our nominees and Our Board of Directors unanimously recommends that you vote FOR the election of each of the nominees.

18 The TJX Companies, Inc.

2019 Proxy Statement 19

The following table shows, as of April

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (2) |

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| |||

|

| common stock with her spouse. |

The total number of shares beneficially owned by each individual and by the group above constitutes, in each case, less than 1% of the outstanding shares of TJX. The amounts above reflect sole voting and investment power except as noted below.noted. The shares listed in the table above reflect the two-for-one stock split effected November 6, 2018 and include:

Vested deferred shares (including estimated deferred shares for accumulated dividends) held by the following directors: Mr. Abdalla 8,539; Mr. Alvarez 41,210;19,028; Mr. Bennett 44,803;94,729; Ms. Berkery 1,069; Mr. Ching 28,133;58,727; Mr. Hines 47,136;99,456; Ms. Lane 38,577;81,002; Ms. Nemerov 2,176;8,362; Mr. O’Brien 56,726;116,659; Ms. Shire 59,727;122,740; and all directors and executive officers as a group 327,027.601,772.

Deferred shares (including estimated deferred shares for accumulated dividends) that are scheduled to vest within 60 days of April 9, 20188, 2019 held by the following directors: Ms. Berkery 1,069, each other non-executive director; director 1,728; and 9,891 held by all directors and executive officers as a group.group 14,893.

673,871.

Shares listed do not include the following, if not scheduled to vest within 60 days of April 9, 2018,8, 2019: unvested performance-based deferred share awards, performance share unit awards, orand restricted stock unit awards.

20182019 Proxy Statement 1921

The following table shows, as of April 9, 2018,8, 2019, each person known by us to be the beneficial owner of more than 5% of our outstanding common stock:

| Name and Address of Beneficial Owner | Number of Shares |

Percentage of Class Outstanding | Number of Shares |

Percentage of Class Outstanding | ||||||||

The Vanguard Group, Inc.(1) 100 Vanguard Boulevard Malvern, PA 19355 |

|

48,569,668 |

|

|

7.7 |

% |

99,603,527 |

8.0% | ||||

BlackRock, Inc.(2) 55 East 52nd Street New York, NY 10055 |

|

45,354,058 |

|

|

7.2 |

% |

90,260,028 |

7.3% | ||||

| (1) | Amounts based on ownership of The Vanguard Group, Inc. |

| (2) | Amounts based on ownership of BlackRock, Inc. and certain subsidiaries at December 31, |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended (the Exchange Act), requires our directors and executive officers to file reports of holdings and transactions in our common stock with the SEC and the NYSE. To facilitate compliance, we have undertaken the responsibility to prepare and file these reports on behalf of our officers and directors. Based on our records and other information, all reports for fiscal 20182019 were timely filed, other than a delay in reporting the transfer of shares held by Mr. Abdalla from direct to indirect shared ownership.filed.

2022 The TJX Companies, Inc.

COMPENSATION DISCUSSION AND ANALYSIS

Our CD&A reviewsCompensation Discussion and Analysis (CD&A) describes the objectives and elements of TJX’s executive compensation program, describes the related processes of our Executive Compensation Committee (ECC), and discusses the fiscal 20182019 compensation for our Named Executive Officers (NEOs), listed below. It also explains the actions our ECC took in response to the shareholder feedback we received during our extensive shareholder outreach on executive compensation during fiscal 2018.:

| NEO | Title | |

Ernie Herrman | Chief Executive Officer and President | |

Scott Goldenberg | Senior Executive Vice President, Chief Financial Officer | |

Carol Meyrowitz | Executive Chairman | |

| Senior Executive Vice President, Group President | |

| Senior Executive Vice President, Group President |

WHERE WE ARE TODAY

TJX is the leading internationaloff-price apparel and home fashions retailer. We have a long successful track record of strong financial performance, including 2223 consecutive years of annual comparable store sale increases, and an executive team with deep experience inoff-price retailing.retail. Having a highly-engagedhighly engaged senior leadership team with the ability to execute our distinctive and flexible retail business model has always been critical to our business. Accordingly, ourstrong performance over many years.

Our fiscal 2019 executive compensation program is designed to drive long-term profitable and sustainable growth, foster management stability, and support our leadership succession plans.

Fiscal 2018 Shareholder Outreach Initiative

We have followed a consistent approachreflects important changes to the design of our executive compensation program, for many years. The history ofwhich our say-on-pay results before 2017 demonstrated strong shareholder support for our program over several years, with support averaging over 95% between 2011 and 2016. But in response to the lower level of support for our 2017 say-on-pay vote, the ECC led anapproved after extensive shareholder outreach initiativeand engagement during fiscal 2018. This outreach focused on better understanding the concerns and perspectives of our shareholders, including those who did not support our say-on-pay vote in 2017. The ECC then made design changes to our fiscal 2019 program that respond to the shareholder feedback we received.

|

This executive compensation outreach initiative was in addition to our regular, ongoing shareholder engagement.

2018 Proxy Statement 21

What We Heard and How We Responded

We heard a range of different perspectives on our executive compensation program from shareholders during our fiscal 2018 outreach, all of which were considered by the ECC.

We received considerable positive feedback about the overall program and support for our management team, consistent with our strong priorsay-on-pay results. Additionally, many of our larger shareholders agreed with the ECC on the importance of having a stable senior leadership team with the knowledge and expertise to execute our distinctiveoff-price business model successfully over the long-term.

However, we also heard some common concerns about specific aspects of our program’s design, discussed below, as well as comments cautioning us against overcomplicating our program or introducing too many changes. Based on this feedback, the ECC examined ways to improve our compensation program without compromising its strengths, including its focus on our core business goals, promoting stability, and driving performance, as well as its overall emphasis on long-term performance incentives. As a result, we made some important modifications to our program, summarized below, and updated our disclosure in several key areas.

|

| |

|

| |

|

| |

|

|

In making these changes, the ECC focused on designing the new program in a way that reflects shareholder concerns and strengthens our ability to drive the execution of ouroff-price business model over the long term, support sustained growth, and continue decades of proven success in all types of business and retail environments.

22 The TJX Companies, Inc.

Fiscal 2019 Executive Compensation Program

The key components of our executive compensation program continue to be base salary, annual cash incentives, and long-term incentives, both cash and equity. The most significant portion of total target compensation for our NEOs continues to be long-term performance-based incentive compensation.

The following summarizes what’s new for fiscal 2019. The key features of our new program—including the new mix of metrics and new design for our long-term incentives—were reviewed as part of our outreach process, and shareholders generally expressed support for these overall design changes during our fiscal 2018 outreach.

NEW MIX OF PERFORMANCE METRICS

The ECC conducted anin-depth review of various possible performance metrics in light of the shareholder preferences we heard and our business strategy. After careful consideration, the ECC determined that the fiscal 2019 program for our NEOs will include the following performance metrics in our incentive plans:

executive compensation program

|

|

| ||||||

|

| |||||||

|

|

| ||||||

|

|

| ||||||

|

|

• • Our program is also intended to sustain our competitive position in a highly competitive and changing retail environment, promote Associate engagement and retention, foster alignment with shareholder interests, and maintain focus on business execution and long-term results. | ||||||

Changes the ECC made for fiscal 2019 | • The ECC led an extensive outreach initiative during fiscal 2018 and made meaningful changes in response to shareholder feedback, including by: / Expanding the performance metrics used in our incentive plans to include a balance of growth, profitability, and return metrics; and / Updating the design of our long-term incentives to increase overall rigor and performance sensitivity through new performance share units (PSUs). • In 2018, 90% of votes cast by our shareholders were in favor of our say-on-pay proposal, which we believe represents strong support for our new program. | |||||||

Performance and pay in fiscal 2019 | • Fiscal 2019 was another excellent year for TJX. We had a very strong consolidated comparable store sales increase of 6%, with increases of 3% or higher in each of our divisions, driven primarily by increased customer traffic. We also had above-plan EPS over last year, despite continued headwinds from cost pressures, and returned $3.4 billion to shareholders through our share repurchase and dividend programs. • Our strong performance led to above-target payouts under our cash incentive programs and full performance vesting of our long-term equity incentive awards.

|

20182019 Proxy Statement 23

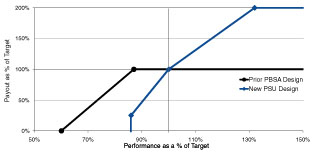

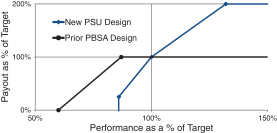

NEW LONG-TERM PERFORMANCE SHARE UNITS (PSUs)

Starting inHIGHLIGHTS OF OUR FISCAL 2019 EXECUTIVE COMPENSATION PROGRAM

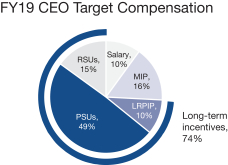

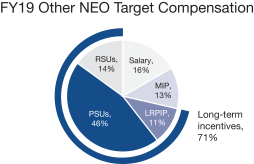

2019 TARGET TOTAL COMPENSATION PAY MIX

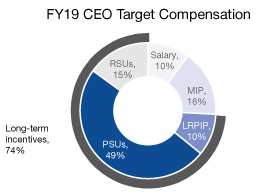

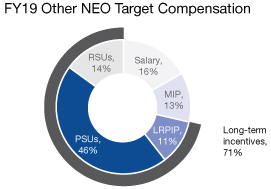

Our fiscal 2019 NEOs will be eligible to receive newprogram maintains an emphasis on long-term equity award grants in the form of PSUs. PSUs will make upperformance incentives, which represent the largest portionpercentage of their target long-term incentives. PSUs granted intotal compensation for our NEOs. Although the pay mix was updated for fiscal 2019, willthe total target grant value of long-term incentives for our CEO and Executive Chairman did not increase as compared to fiscal 2018. The charts below show the mix of fiscal 2019 target total compensation for our CEO and our other NEOs.

|  |

Additional details about the elements of our program can be earned basedfound below starting on the achievementp. 31.

2019 PERFORMANCE METRICS

Our incentive plan metrics are intended to align with our long-term business strategy, and our fiscal 2019 program had a new mix of challenging EPS compound annualperformance measures that seek to balance growth, rate (CAGR) goals measured at the end of a three-year performance cycle (fiscal 2019-2021). The new PSUs will also be subject to a downward ROIC modifier, which means that if the company does not achieve its ROIC goals, award payouts will be adjusted downward by 20%.profitability, and returns:

| ||||||||||||

Pre-Tax Income

| ||||||||||||

|

| |||||||||||

| ||||||||||||

EPS Growth |

| |||||||||||

|

Supplemental metric

representing top line

performance

Primary long-term measure | Long-term modifier |

The EPS growth target goalAdditional details about these metrics and how they are used in our program are included below, starting on p. 31.

EMPHASIS ON PERFORMANCE INCENTIVES

Our PSU awards were new for fiscal 2019-2021 is aligned with2019 and comprised the largest component of target total compensation for our long range business plan, withNEOs. The design of our new PSU program added additional rigor and increased the target reflecting meaningful growth over the three-year period. The threshold level reflects the minimal levelpay sensitivity of growth during the three-year period required for any payout, and the maximum level is intended to be a significant stretch goal for the period. The ROIC modifier is intended to ensure that a full payout based on EPS results will be made only if we also generate meaningful returns over the three-year period.

Comparedour long-term performance incentives, compared to the design of our previous performance-based stock awards (PBSAs), which were intended to serve as vehicles for stability and retention and not solely as performance incentives, the new PSU design adds more performance sensitivity and increases the overall rigor of the program.. The number of PSUs eligible to vest will be reduced for performance below target, and a higher threshold level of performance is required for any of the PSUs to vest, as compared to our prior PBSAs (as illustrated below).PBSAs.

* Performance level for PSUs is expressed as a percent of target based on EPS at the end of the fiscal 2019-2021 performance period, which corresponds to the target EPS CAGR goal for the period.

24 The TJX Companies, Inc.

2019 TARGET TOTAL COMPENSATION PAY MIX

Key elements of our fiscal 2019 target compensation mix for our NEOs are as follows:

The charts below show the mix of fiscal 2019 target total compensation for our CEO and our other NEOs.

|  |

2018 Proxy Statement 25

Continued Focus on Good Compensation Governance

HIGHLIGHTS OF OUR COMPENSATION GOVERNANCE

Our compensation governance practices, over the past several years, highlighted in the table below, reflect the ECC’s focus on strong and effective oversight of the ECC:governance:

What We Do and What We Don’t Do |

| ✓ | Pay for performance, directly tying incentive compensation to the achievement of objective performance metrics | |

| ✓ | Award limits on maximum plan payouts | |

| ✓ | Emphasis on long-term opportunities for equity and cash incentives | |

| ✓ | Stock ownership guidelines for our executive officers andnon-employee directors, updated during fiscal 2019 | |

| ✓ | Clawback policy applicable to our executive officers, amended during fiscal 2019 | |

| ✓ | ||

| ✓ | ||

| No change of control excise taxgross-ups | |

| No single-trigger severance benefits upon a change of control | |

| No automatic full acceleration of equity awards upon a change of control | |

| No hedging or pledging of company stock by our executive officers | |

| No dividends on unearned stock awards | |

| No repricing or exchange of underwater stock options without shareholder approval | |

SHAREHOLDER OUTREACH AND ECC RESPONSIVENESS

Our executive compensation program for fiscal 2019 reflects an extensive shareholder outreach initiative led by the ECC during fiscal 2018 in response to the results of oursay-on-pay vote in 2017. Before the ECC approved the new program design for fiscal 2019, we sought initial feedback from shareholders, worked to redesign our program based on the initial feedback, and then sought additional feedback on potential design changes from our shareholders. We reached out to shareholders representing over 50% of shares outstanding, and held discussions with more than 37% of shares outstanding and with proxy advisory firms. The entire process was overseen by the ECC between May 2017 and April 2018. We believe our shareholders strongly supported the changes to our fiscal 2019 executive compensation program, consistent with the results of oursay-on-pay vote in 2018 where we received 90% support (compared to 58% in 2017).

During fiscal 2019, we continued our outreach to shareholders on executive compensation matters and the key features of our new program. The ECC also undertook a review of our compensation recovery and forfeiture practices following a 2018 shareholder vote on our clawback policy, as discussed below on p. 40.

FOCUS ON GOAL-SETTINGGOAL SETTING

Each year, the ECC sets objective business performance targets and the amounts payable at different levels of performance under each ofestablishes goals for our incentive plans. These goalsplans that are part oftied to our strategic planning process and are derived from our Board-approved annual and multi-year business plans.plans that are reviewed with and overseen by our Board. Our incentive plan targets are generally set at levels that align with the financial guidance we provide to investors. Atinvestors and are intended to be challenging but reasonably achievable. Historically, this process has resulted in incentive plan goals that demonstrate the timerigor of our program over time:

Our annual incentive program has had year-over-year increases in our corporate performance targets for the goals are established,past five years, and fiscal 2019 annual performance targets were set higher than prior year targets and actual results.

Our long-term incentive program has had consecutive increases in our long-term cash performance targets for three-year cycles beginning in fiscal 2017, fiscal 2018, and fiscal 2019, and we introduced a three-year EPS growth target in our new PSU program that started in fiscal 2019.

THOUGHTFUL DECISION MAKING PROCESS

In overseeing executive compensation and making compensation decisions throughout the year, the ECC follows a thoughtful and deliberate approach that considers a variety of important qualitative and quantitative factors including:and seeks to balance potential business risk, performance, and rewards. The annual process includes competitive analysis, market checks, executive assessments, an annual compensation risk assessment, and input from an independent compensation consultant that has been engaged by and reports directly to the ECC. (SeeThe Decision Making Process, starting on p. 28, for more information.)

2019 Proxy Statement 25

FISCAL 2019 REVIEW

Our fiscal 2019 results reflect strong execution of our business plan and growth strategies, as we increased annual comparable store sales profitability,in all divisions, primarily driven by strong customer traffic gains, and earnings;

FISCAL 2019 BUSINESS REVIEW

Financial Results/ Business Execution1 | Shareholder | Business/Strategic | ||||||

• $39.0 billion net sales, an increase of 9% over fiscal 2018 • Comparable store sales increased 6% over a 2% increase in fiscal 2018, driven primarily by customer traffic increases in every division • Fourth quarter net sales were $11.1 billion and comparable stores sales were up 6% for the quarter over 4% growth in the same period last year | • 26.8% total shareholder return • Returned $3.4 billion to shareholders through our share repurchase and dividend programs • Increased dividend by 25% during fiscal 2019; announced plan to increase current dividend by 18% in fiscal 2020 • $59.5 billion market cap atfiscal year-end | • Successfully grew our global store base by a net 236 stores globally during fiscal 2019 • Expanded to 4,306 total stores at fiscalyear-end across 9 countries • Continued to invest in distribution capabilities and systems to support growth plans |

| 1 | Fiscal 2018 was a 53-week year. Fiscal 2019 was a 52-week year. Comparable store sales are defined in Appendix A. |

Our EPS growth continued in fiscal 2019, and our various businesses;

|  |

Historically, this process has led to year-over-year increases in our annual corporate MIP targets over the past five years, demonstrating the rigor and consistent growth in these programs over time.

As part of the goal-setting process, at the time the goals are established the ECC also establishes definitions of the applicable financial metrics (including, for example, planned exchange rates for foreign currency translation) and automatic adjustments (including, for example, for unplanned changes in accounting standards, acquisitions, or dispositions) that would apply during the performance period. The ECC uses these definitions and adjustments to better align our incentive plans with how we evaluate our business operations and trends and, in some cases, to allow certain strategic decisions to be made in the long-term interests of TJX without being influenced by incentive plan results. The effect of these items on our incentive plan results is included in the details below. The ECC has not made any discretionary increases to incentive plan payouts for our NEOs in recent years.

| * | See Appendix A to the proxy statement for notes on Annual Sales Growth chart and reconciliations of adjusted EPS to GAAP EPS. |

26 The TJX Companies, Inc.

FISCAL 2019 INCENTIVE PLAN PERFORMANCE

Our strong business performance in fiscal 2019 led to the following results under our performance-based incentive plans.

Annual Incentives | Long-Term Incentives | |||

Actual results were above our targets for our annual incentive plan (MIP), driven by strong sales execution and focus on profitability • Pre-tax Income for MIP exceeded our fiscal 2019 target at 105.31% of target, resulting in a payout percentage of 158.44% for that metric • Total Sales for MIP exceeded our fiscal 2019 target at 103.72% of target, resulting in a payout percentage of 189.26% for that metric, which was then capped at 158.44% based on the plan design that limits upside impact of sales results | Actual results were above our target for our long-term incentives that were linked to the fiscal 2017 – 2019 performance cycle, reflecting the consistency and strength of the company’s performance over the longer term • Pre-tax Income for LRPIP exceeded our fiscal 2017-2019 target at 106.30% of target, resulting in a payout of 115.74% • LRPIP performance resulted in full performance vesting for the previously granted PBSAs covering the fiscal2017-2019 performance period |

For more detail about plan goals and payout mechanics and definitions of Pre-tax Income for MIP, Total Sales for MIP, and Pre-tax Income for LRPIP, seeAnnual Cash Incentives: Management Incentive Plan (MIP) starting on p. 33 andLong-Term Incentives starting on p. 34.

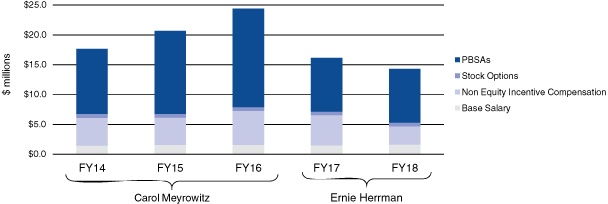

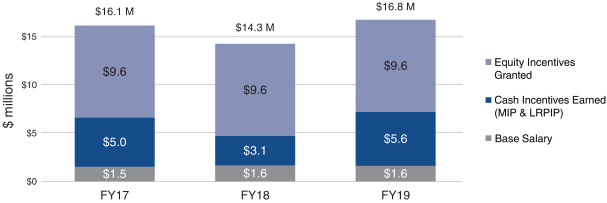

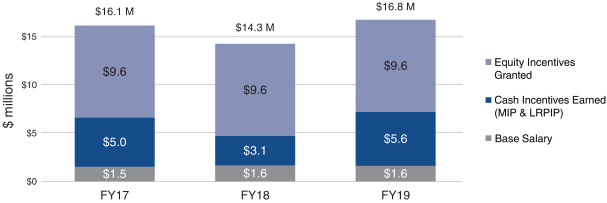

CEO TOTAL DIRECT COMPENSATION

The chart below shows the total direct compensation1 of our CEO for fiscal 2019, including results of our cash incentive payouts, compared to fiscal 2017 and fiscal 2018.

1 Total direct compensation for each fiscal year consists of the following elements: base salary, earned cash incentives (MIP and LRPIP with performance periods ending in the fiscal year), and the grant date fair value of equity incentives granted during the fiscal year (PSUs and RSUs for fiscal 2019 and PBSAs and stock options for fiscal 2017 and fiscal 2018). PBSA and stock option grants have been eliminated from the program as of fiscal 2019.

2019 Proxy Statement 27

THE DECISION MAKING PROCESS

THE ROLE OF THE EXECUTIVECEO TOTAL DIRECT COMPENSATION COMMITTEE

The ECC, a committee of our Board of Directors composed entirely of independent directors, overseeschart below shows the compensation of our executive officers, including the NEOs. In determining the overall level of executive compensation and establishing the design and mix of specific elements, the ECC follows a thoughtful and deliberate process and considers various quantitative and qualitative factors, such as:

The ECC approaches executive compensation as part of the overall strategic framework for total rewards at TJX. This framework applies to all TJX associates and reflects our global total rewards principles, which include sharing in the success of the company, encouraging teamwork and collaboration across a diverse workforce, and being fair and equitable.

The ECC consults with and reviews data from an independentdirect compensation consultant, discussed further below, to assess the overall competitiveness of our NEOs’ compensation and our executive compensation program and to determine the appropriate levels and the mix of individual compensation components.

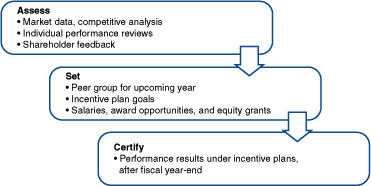

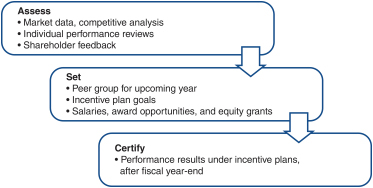

In addition to any special actions the ECC may take throughout the year in connection with its other charter responsibilities, the ECC typically reviews and approves elements of our NEOs’ compensation using the following general process:

THE ROLE OF EXECUTIVES

Our executive officers play a limited role in determining executive compensation. The ECC invites our executive officers to attend portions of its meetings, and they participate in our strategic planning process, discuss business and organizational strategies with the Board, and recommend to the Board, for its review and approval, the annual and multi-year plans for TJX and our divisions. These Board-approved plans form the basis for the performance targets of our short- and long-term incentive plans, and those targets are approved by the ECC. The ECC also receives individual performance evaluations, based in part on executive self-assessments,1 of our CEO for fiscal 2019, including results of our cash incentive payouts, compared to fiscal 2017 and Executive Chairmanfiscal 2018.

1 Total direct compensation for each fiscal year consists of the following elements: base salary, earned cash incentives (MIP and LRPIP with performance periods ending in the fiscal year), and the grant date fair value of equity incentives granted during the fiscal year (PSUs and RSUs for fiscal 2019 and PBSAs and stock options for fiscal 2017 and fiscal 2018). PBSA and stock option grants have been eliminated from the Corporate Governance Committee (which does not make executive compensation recommendations). For eachprogram as of our other NEOs, the CEO makes compensation recommendations to the ECC based in part on the individual annual performance evaluations of these executives. These evaluations from the Corporate Governance Committee and the CEO take into account the NEO’s individual responsibilities, performance, andfiscal 2019.

20182019 Proxy Statement 27

support of TJX’s cultural values. The ECC considers these executives’ performance evaluations and the CEO’s recommendations, among other factors, in establishing compensation for our NEOs.

THE ROLE OF COMPENSATION CONSULTANTS

The ECC engaged Pearl Meyer & Partners, LLC (Pearl Meyer) to serve as the independent compensation consultant to the ECC for fiscal 2018. Pearl Meyer attended all of the ECC’s meetings during the fiscal year and was available to the ECC on an ongoing basis throughout the year. Pearl Meyer provided industry, peer, and market data and advised the ECC on a variety of matters, including the design and competitive positioning of key compensation elements (base salary, annual bonus, and long-term cash and equity incentives) for our NEOs and other senior management; short-term and long-term relationships between NEO pay and corporate performance relative to our peers; the establishment and evaluation of a compensation peer group; the design and competitive positioning of our new compensation program for fiscal 2019; employment agreement terms; aggregate equity program usage; and updates on practices, trends, and regulatory developments as well as on otherpay-related matters. The ECC used this information and advice from Pearl Meyer as a reference in making its executive compensation decisions and determinations about the design, overall level and mix of compensation, plan metrics, goals and formulas, and individual compensation components, including benefits and perquisites.

Pearl Meyer did not perform any services for TJX other than work for or requested by the ECC and for the Corporate Governance Committee on director compensation. Pearl Meyer reported directly to the ECC, which determined the scope of Pearl Meyer’s engagement and its fees.

The ECC regularly reviews the services provided to the ECC by outside consultants. During fiscal 2018, the ECC reviewed its existing relationship with Pearl Meyer, including potential conflicts of interest, and determined that Pearl Meyer’s work for the ECC did not raise any conflicts of interest and that Pearl Meyer continued to be an independent advisor to the ECC.

THE ROLE OF OUR PEER GROUP

The ECC uses data from a peer group to inform its compensation decision-making for our NEOs. The ECC annually assesses the composition of this peer group. During fiscal 2017, the ECC considered what would be an appropriate peer group to evaluate fiscal 2018 compensation practices and pay levels. After consultation with Pearl Meyer, the ECC determined that the following group of 16 large, publicly traded consumer-oriented companies listed below would be appropriate to use for fiscal 2018.

FY 18 Peer Companies

FY 18 Peer Company Comparison

Peer Data

|

Revenue ($B)*

|

Market Cap ($B)*

| ||||||||

Median | $ 25.5 | $ | 40.7 | |||||||

TJX | $ 32.7 | $ | 49.0 | |||||||

TJX Percentile Rank | 59th | 56th | ||||||||

| *Revenue is trailing four quarters at the end of 2016. Market cap is as of December 30, 2016. | ||||||||||

28 The TJX Companies, Inc.

The ECC established the fiscal 2018 peer group after taking into account TJX’s growth and continued global focus, coupled with challenges facing smaller peers in the domestic retail industry. Criteria used in constructing the peer group included:

Compared to our fiscal 2017 peer group, the fiscal 2018 peer group removed five companies that in the judgment of the ECC no longer fit our size and business focus criteria: Amazon.com, Inc.; Bed Bath & Beyond Inc.; eBay, Inc.; Staples, Inc.; and YUM! Brands, Inc. The ECC also added three companies that it determined are more comparable in size, scale, and global focus: McDonald’s Corporation; PepsiCo, Inc.; and The Procter & Gamble Company. As shown in the table above, TJX was above the median of the fiscal 2018 peer group in both revenue and market cap.

The ECC uses peer group data to inform the competitiveness of compensation and program design and believes that this data provides important context for its compensation decisions. At the same time, the ECC recognizes that ouroff-price retail business model, in combination with our size and global focus, is distinct from other companies and the ECC does not rely on strict benchmarking or target any element of NEO compensation by reference to any specified level of compensation within the peer group. The ECC has also supplemented peer group data from time to time with additional case studies and market data to provide further context for its compensation decisions.

CONSIDERATIONS FOR EXECUTIVE CHAIRMAN COMPENSATION

Ms. Meyrowitz assumed the role of Executive Chairman at the start of fiscal 2017 and is an active and integral member of the executive management team in addition to serving as Chairman of the Board. Our Board believes strongly that Ms. Meyrowitz, who has wide ranging,in-depth knowledge of our business and the retail industry overall, continues to play a critical role as an executive at TJX in addition to providing effective leadership to the Board. In her role as Executive Chairman, she serves as a key resource in the areas of merchandising, marketing, and internal training, and provides support to our CEO, CFO, and other members of senior management, with an emphasis on strategic initiatives and long-term company strategy.

The ECC recognizes that the role of executive chairman varies across companies. In establishing compensation for Ms. Meyrowitz, the ECC, advised by Pearl Meyer, evaluated other Fortune 200 companies with executive chairman positions and took into account the degree of active involvement that Ms. Meyrowitz would have as part of the management team at TJX relative to other executive chairman roles that may be more limited or transitional in nature.

2018 Proxy Statement 29

FISCAL 2018 REVIEW

During fiscal 2018, we solidly executed our business plan and growth strategies, increasing comparable store sales, driven by customer traffic, and growing our store base globally while maintaining focus on driving profitable sales, reinvesting in the business, managing expenses, and returning value to shareholders. These and other events during the year contributed to our annual incentive plan results, as described below. At the beginning of fiscal 2019, we announced plans to continue our growth and reinvestment initiatives, including driving comparable store sales and customer traffic gains, increasing ourlong-term store growth potential for some of our chains and, in light of U.S. tax law changes, planning a more substantial share buyback program and increase to our quarterly dividends and additional investments in our Associates and our communities.

FISCAL 2018 BUSINESS REVIEW

(53 weeks)

| ||||||||

|

|

|

|  |

30 The TJX Companies, Inc.

FISCAL 2018 INCENTIVE PLAN PERFORMANCE

Our performance in fiscal 2018 led to the following results under our performance-based incentive plans:

Additional details about these performance results and the payouts for each NEO are included below.

CEO TOTAL DIRECT COMPENSATION

The chart below shows the total direct compensation1 of our CEO for fiscal 2019, including results of ournon-equity cash incentive compensation payouts, compared to recent years.fiscal 2017 and fiscal 2018.

1 Total direct compensation for each fiscal year consists of the following elements: base salary, earned cash incentives (MIP and LRPIP with performance periods ending in the fiscal year), and the grant date fair value of equity incentives granted during the fiscal year (PSUs and RSUs for fiscal 2019 and PBSAs and stock options for fiscal 2017 and fiscal 2018). PBSA and stock option grants have been eliminated from the program as of fiscal 2019.

|

20182019 Proxy Statement 3127

THE DECISION MAKING PROCESS

THE ROLE OF THE EXECUTIVE COMPENSATION COMMITTEE

The ECC, a committee of our Board of Directors composed entirely of independent directors, oversees the compensation of our executive officers, including the NEOs. In determining the overall level of executive compensation and establishing the design and mix of specific elements, the ECC considers a number of quantitative and qualitative factors, including:

The ECC approaches executive compensation as part of the overall strategic framework for total rewards at TJX. This framework applies to all TJX Associates and reflects our global total rewards principles, which include sharing in the success of the company, encouraging teamwork and collaboration across a diverse workforce, and being fair and equitable.

The ECC consults with and reviews data from an independent compensation consultant (discussed further below) to assess the overall competitiveness of our NEOs’ compensation and our executive compensation program and to determine the appropriate levels and the mix of individual compensation components.

In addition to any special actions the ECC may take throughout the year, the ECC typically reviews and approves the elements of our NEOs’ compensation using the following general process:

THE ROLE OF EXECUTIVES

Our executive officers play a limited role in determining executive compensation. The ECC may invite our executive officers to attend portions of its meetings, discuss business and organizational strategies with the Board, and review with the Board the annual and multi-year business plans for TJX and our divisions. These business plans form the basis for the performance targets for our short- and long-term incentive plans, and those targets are approved by the ECC. The ECC also receives individual performance evaluations of our CEO and Executive Chairman from the Corporate Governance Committee (which does not make executive compensation recommendations). For each of our other NEOs, the CEO makes compensation recommendations to the ECC based in part on individual annual performance evaluations of these executives. Individual performance evaluations take into account the NEO’s individual responsibilities, performance, self-assessments, and support of TJX’s cultural values. The ECC considers these executives’ performance evaluations and the CEO’s recommendations, among other factors, in establishing compensation for our NEOs.

28 The TJX Companies, Inc.

THE ROLE OF OUR PEER GROUP

The ECC uses peer group data to inform its compensation decision-making for our NEOs. The ECC annually assesses the composition of this peer group. During fiscal 2018, the ECC considered what would be an appropriate peer group to be used to provide context for making compensation decisions for fiscal 2019. After consultation with Pearl Meyer & Partners, LLC (Pearl Meyer), the ECC determined that the following group of 16 large, publicly traded consumer-oriented companies listed below would continue to be appropriate to use for fiscal 2019.

FY19 Peer Companies

| Best Buy | L Brands | Nike | Ross Stores | |||

| Gap | Lowe’s | Nordstrom | Starbucks | |||

| Kimberly-Clark | Macy’s | PepsiCo | Target | |||

| Kohl’s | McDonalds | Procter & Gamble | The Home Depot |

The ECC evaluated the peer group for fiscal 2019 and determined that it continued to be appropriate after taking into account TJX’s growth and global operations, coupled with challenges facing smaller peers in the domestic retail industry. The ECC considered criteria beyond standard industry classifications in constructing and evaluating the peer group, including:

industry similarity, targeting retail companies and also considering consumer product companies that met complexity criteria;

revenues and market capitalization;

business complexity, reflected by factors such as significant global operations, brand and/or product line diversity, multiple segments, ande-commerce strategy; and

financial performance metrics, including operating and market performance.

The ECC approved the fiscal 2019 peer group based on the analysis described above. At the time of the peer group evaluation for fiscal 2019, TJX was, and as of the end of fiscal 2019 continued to be, above the peer group median in both revenue and market cap, and the ECC believed that the fiscal 2019 peer group was an appropriate comparator group for TJX in terms of size, industry, business focus and overall complexity of operations, channels and customer focus. For comparisons of TJX performance to the fiscal 2019 peer group through the end of fiscal 2019, seeFiscal 2019 Business Review on p. 26.

The ECC uses peer group data to inform the competitiveness of NEO compensation and to evaluate program design, marketplace practices, and the relationship of pay and performance on a relative basis. The ECC believes that peer group data provides important context for its compensation decisions. At the same time, the ECC recognizes that ouroff-price retail business model, in combination with our size and global focus, is distinct from other companies. The ECC does not rely on strict benchmarking or target any element of NEO compensation by reference to any specified level of compensation within the peer group. The ECC has also supplemented peer group data from time to time with additional case studies and market data to provide further context for its compensation decisions.

2019 Proxy Statement 29

THE ROLE OF COMPENSATION CONSULTANTS

The ECC engaged Pearl Meyer to serve as the independent compensation consultant to the ECC for fiscal 2019. Pearl Meyer attended all of the ECC’s meetings during the fiscal year and was available to the ECC on an ongoing basis throughout the year. Pearl Meyer provided industry, peer, and market data and advised the ECC on a variety of matters, including the design and competitive positioning of key compensation elements (base salary, annual bonus, and long-term cash and equity incentives) and our new fiscal 2019 compensation program for our NEOs and other senior management; short-term and long-term relationships between NEO pay and corporate performance relative to our peers; the establishment and evaluation of a compensation peer group; employment agreement terms, severance arrangements and our Executive Severance Plan, and compensation forfeiture and recovery policies and practices; aggregate equity program usage; and updates on practices, trends, and regulatory developments as well as on otherpay-related matters. The ECC used this information and advice from Pearl Meyer as a reference in making its executive compensation decisions and determinations about the design, overall level and mix of compensation, plan metrics, goals and formulas, and individual compensation components, including benefits and perquisites.

Pearl Meyer did not perform any services for TJX other than work for or requested by the ECC and for the Corporate Governance Committee on director compensation. Pearl Meyer reported directly to the ECC, which determined the scope and terms of Pearl Meyer’s engagement.

The ECC regularly reviews the services provided to the ECC by outside consultants. During fiscal 2019, the ECC reviewed its existing relationship with Pearl Meyer, including potential conflicts of interest, and determined that Pearl Meyer’s work for the ECC did not raise any conflicts of interest and that Pearl Meyer continued to be an independent advisor to the ECC.

30 The TJX Companies, Inc.

FISCAL 20182019 EXECUTIVE COMPENSATION PROGRAM

Program elements:Our fiscal year 20182019 executive compensation program consisted of base salary and annual and long-term incentives as summarized below:below.

| Base Salary |

Salary • Provide a base level of compensation to reflect individual roles and responsibilities,

• Recognize individual performance

| |

Annual Cash Incentives |

Management Incentive Plan (MIP)

• Incentivize performance to reach or exceed our annual financial

• Encourage engagement, teamwork, and collaboration within divisions

| |

Incentives |

Equity:

• Align executive interests with shareholders and reward stock performance

•

• Support longer-term retention objectives

Cash: Long Range Performance Incentive Plan (LRPIP)

• Incentivize performance to reach or exceed our longer-term financial

• Foster teamwork and collaboration across divisions

• Support longer-term retention objectives

|

Our program also includes health and welfare, deferred compensation, and retirement benefits, as well as relocation-related benefits and limited perquisites. Our overall executive compensationSeeOther Compensation Practices and Considerations starting on p. 38.

Performance metrics: The ECC conducted an in-depth review of compensation-related performance measures during fiscal 2018 and, after careful consideration, determined that the fiscal 2019 program is intended to sustainfor our competitive position, promote Associate engagement and retention, foster alignment with shareholder interests, and support effective leadership development, succession planning, and leadership transitions, which we believe are critical to our success.NEOs would include the following mix of metrics:

| Performance Metric | Why It’s Included | How It’s Used | ||

| Pre-Tax Income | • Reflects divisional profitability, including bothtop-line performance and effective management of expenses • Highly relevant to our business, well understood, and part of broad-based incentive program for all TJX management | • Primary but not sole metric in our annual MIP program, weighted at 80% • Three-year cumulative metric in our long-term cash program (LRPIP) | ||

| Total Sales | • Demonstrates attention totop-line growth • Highly visible and easy to understand | • Secondary measure in our MIP program, weighted at 20% • Limited upside from sales; MIP payout formula restricts sales impact to maintain overall emphasis on profitability | ||

| EPS Growth | • Maintains critical focus on profitable growth • Reinforces attention to capital discipline and corporate results • Important measure internally and externally | • Primary measure in our new long-term PSU program • Excludes the impact of certain unplanned items, such as unbudgeted buybacks and unanticipated changes in corporate tax rates | ||

| ROIC | • Reinforces attention to capital investments and generating appropriate returns | • Secondary measure in our new long-term PSU program • Used as downward-only modifier |

32 2019 Proxy StatementThe TJX Companies, Inc. 31

Incentive plan goal setting:As described above on p. 25, each year the ECC sets objective business performance targets and the amounts payable at different levels of performance under each of our incentive plans. At the time the goals are established, the ECC considers a variety of qualitative and quantitative factors, including:

estimated long-term trends in sales, comparable store sales, profitability, and earnings;

maturity of our various businesses;

strategic investments to support our growth;

external factors (such as market competition, currency volatility, and wage and other cost pressures);

balance of potential business risks, performance, and rewards;

historical performance against targets and relative to peers and the market; and

degree of difficulty in achieving various levels of performance.